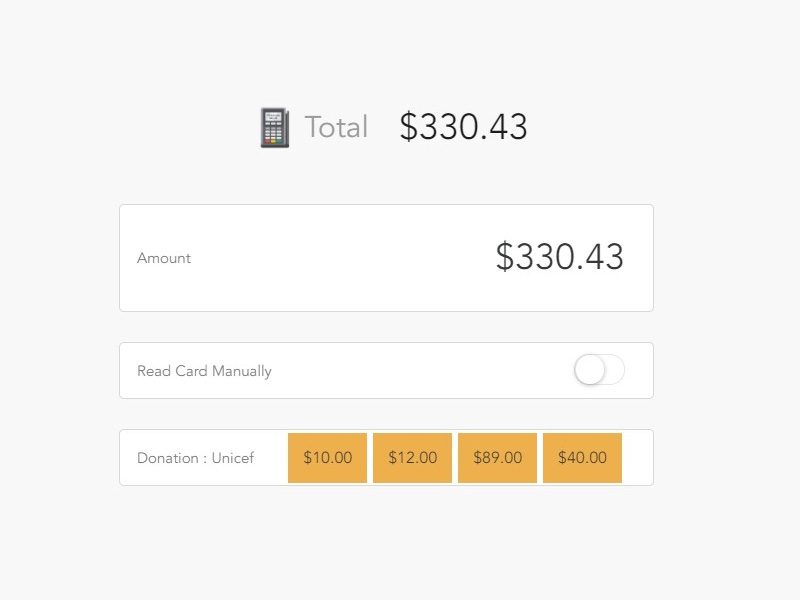

Even before COVID-19, physical cash use has been in decline. People enjoy the convenience of using credit, debit, or processing NFC payments with their electronic devices. Some people like to order online from their home and pick up at the store.

Many consumers enjoy reward points that may range from 1% to 5% or more when using credit cards. It is a no-brainer for them to enjoy the convenience and bonus for using the cards. Credit card points can add up for excellent prices or cold hard cash deposited into a consumer’s account or mailed to them via check.

Many consumers enjoy reward points that may range from 1% to 5% or more when using credit cards. It is a no-brainer for them to enjoy the convenience and bonus for using the cards. Credit card points can add up for excellent prices or cold hard cash deposited into a consumer’s account or mailed to them via check.

Cards and electronic payments also provide a lot of additional safety against crime. It is no longer necessary to take the chance of being robbed while withdrawing money at an ATM or carry bills around and risk being the victim of crime. Additionally, if a consumer loses cash, it is gone, but if they lose a credit card, there are consumer protections even if the card is used.

It is easier for people to carry their mobile devices (which they already have in hand) or credit/debit cards and not have to worry about cash. Keeping track of paper and coins is a lot of trouble, and they take physical room in people’s pockets. Folks don’t want to be bogged down!

During COVID-19, many merchants have moved to stop accepting cash. Exchanging physical money is risky because the virus may live on surfaces for a long time. Cash also encourages closer contact and is slower to negotiate. Alternatively, if someone can purchase from their computer or device and then pick up at the store, no physical money has to exchange hands, and the transaction is clean and quick.

Cashless also has many benefits for merchants. It cuts down on loss due to the mishandling of funds and also reduces cashier theft. Being cashless makes managing a register much easier too.

Cash has been around for a while and is not going away tomorrow. But as times change, it will be used less, and alternative methods will be used instead.

About The Author: Madison Russell

Madison has been an avid tech writer for over a decade in point of sale and eCommerce related field. A former software engineer graduate and currently a pretty good cook. Madison loves to spend time reading about innovative software and participate in various new gadget studies.

More posts by Madison Russell